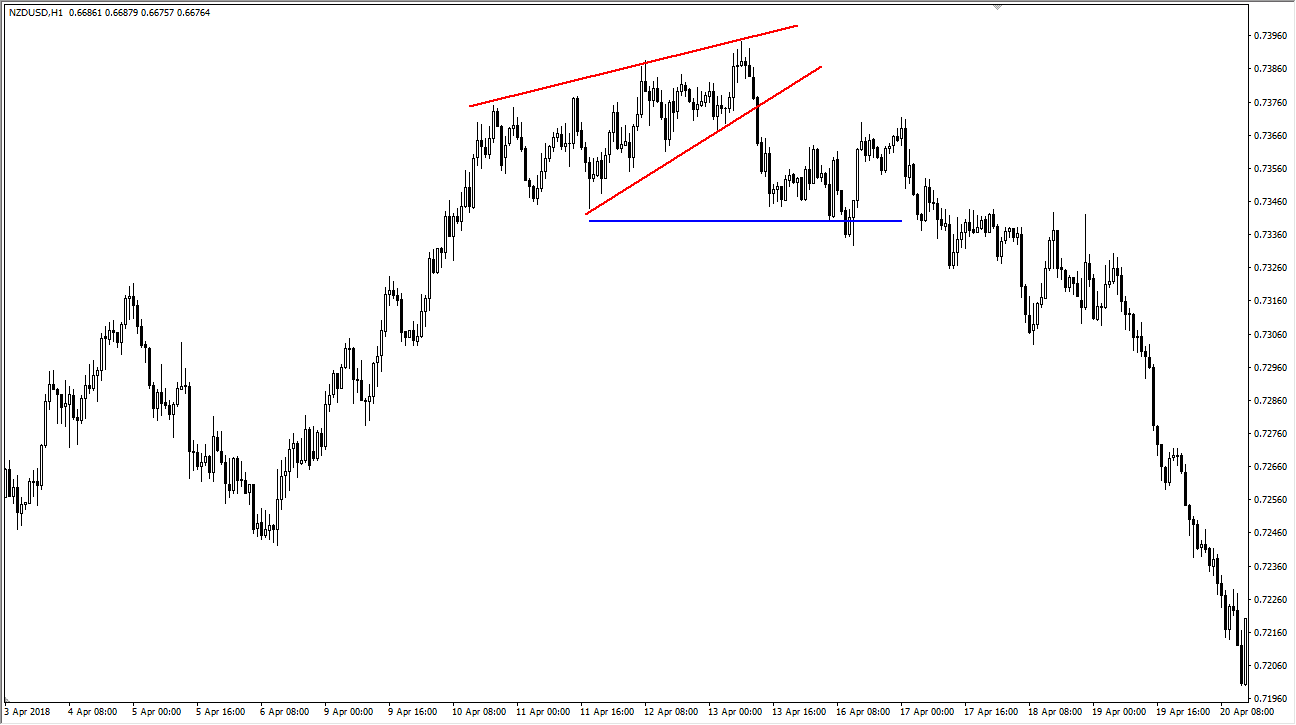

The wedges are classified into two types- The Rising Wedge and the Falling Wedge.Īs the name suggests, a Rising Wedge pattern means the trendline is going upwards and converging at that moment. The eccentric quality of this chart is that the highs and lows of price coincide at a point to form a triangular shape. Wedge Pattern sustains for 10-50 trading periods and is frequently visible on any asset’s price chart. However, a rookie must learn and understand about it to comprehend the Wedge Pattern. Additionally, these wedges provide answers without much hassle as they are easy to read and interpret. Wedges are prominent in all trading communities and are trusted by the masses of traders too. One of these patterns is also called the Wedge Pattern. Hence, technical traders make use of different chart patterns and tools to indulge in profitable trading sessions. Trading is not a game of guesses as a trader, you need to make informed decisions that give you excellent returns on your funds. Pros and Cons of Falling and Rising Wedge.Identifying beneficial trade exit points.Identifying valuable trade entry points.Fibonacci retracement and extension levels.MACD or Moving Average Convergence Divergence.Moving average, divergence indicators, and momentum.

RISING WEDGE MEASURED MOVE HOW TO

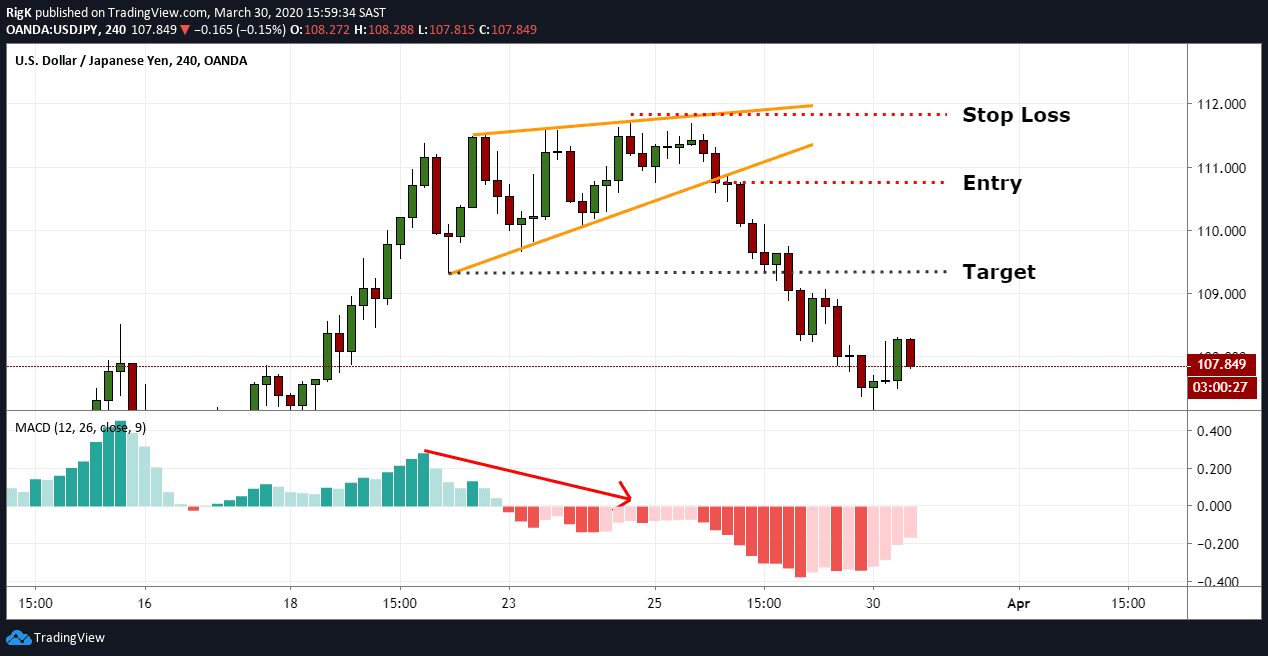

How to enhance the reliability of the rising and Falling Wedge patterns in the market?.Understanding the Falling Wedge pattern.Stage 2: The intersection or convergence phase.With the use of geometry and shape recognition.How to recognize the rising and falling wedge patterns?.Having a repeatable checklist of steps can insure that you stick to your rising wedge trading plan. Using these steps help to stack the odds in your favor. Since MACD confirms trend direction as well as forecasts turning points, the presence of negative MACD divergence preceding a breakout can give traders an additional layer of confidence that the downward slide is near. The fourth step that I use is the addition of MACD confirmation. The first three steps are at the core of what Forex traders can use to trade the rising wedge pattern. The final step is to set an entry order to short GBPCHF around four pips below the last low of 1.4487 that was made on. The last swing high was reached on December 10 th at 1.4645 so a stop can be placed just above that level. A typical trader mistake is to risk more on a trade than they stand to make in profit.

This stop loss level should be less than our profit target. Next, we identify the last swing high within the pattern in order to set a protective stop loss. Subtracting 697 from 1.4511 we come up with a profit target located at 1.3814.

We can now use this “pip measurement” to determine the profit target. In this case, the height of the pattern is around 697 pips. As this could be a very large distance, traders can also use the height of the pattern to obtain a profit target as well. Each rising wedge will typically imply a drop equal in distance from the last significant high use price patterns to anticipate when and where a breakout may happen. After rebounding from a low at 1.3964 made on to a high of 1.4922 on, GBPCHF has broken down below the rising trend line that formed the bottom of this rising wedge at 1.4511. GBPCHF has declined some 500 pips since reaching a high of 1.5475 back on. 4_Steps_for_Trading_GBPCHF_Rising_Wedge_body_Picture_1.png, 4 Steps to Trade GBPCHF Rising Wedge

0 kommentar(er)

0 kommentar(er)